__________________________________________________________________________

Oct ,2025

Written by Mohd Sedek bin Jantan, IPPFA’s Director, Investment Strategist and Country Economist

The latest hashtag#FOMC decision underscores a clear shift in global monetary conditions, with the hashtag#Fed delivering a third 25bps cut despite its most divided vote in years, signalling a cautious easing phase shaped by still-sticky inflation and emerging labour-market softness. The forward profile remains distinctly hawkish, as policymakers prioritise inflation-control credibility while providing only modest insurance against downside risks. In this environment, we expect BNM to maintain the hashtag#OPR at 2.75 per cent. Such policy stability supports orderly credit intermediation, sustains business and household planning horizons, and preserves macro-financial resilience amid rising external volatility.

__________________________________________________________________________________________________

11 Oct, 2025

Written by Mohd Sedek bin Jantan, IPPFA’s Director, Investment Strategist and Country Economist

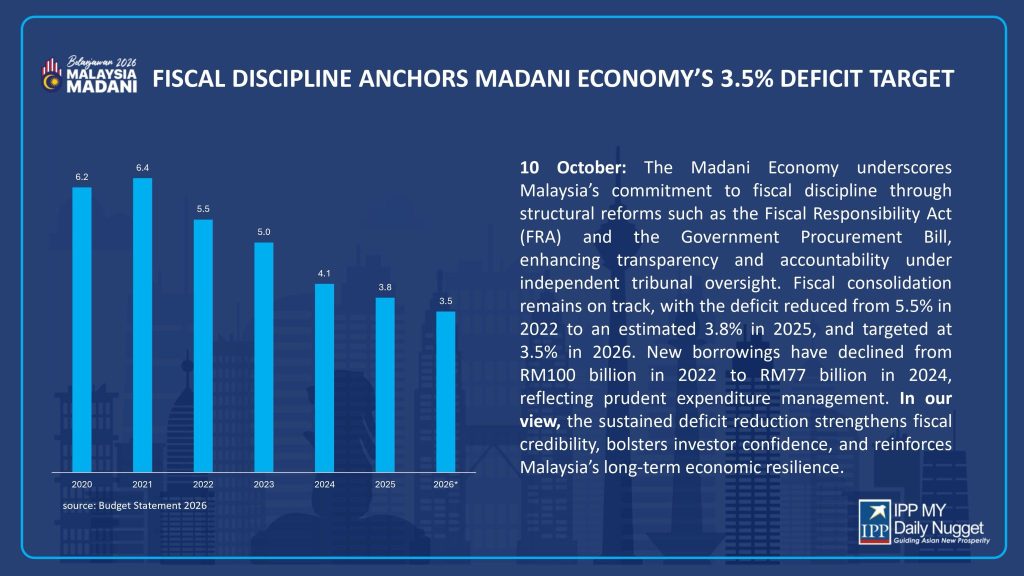

• Deficit narrowing to 3.5% of GDP under FRA discipline

• RM40 billion in off-budget funding via GLICs and PPPs

• RM2.55 billion in semiconductor and digital infrastructure

• MGS yield outlook and ringgit trajectory into 2026